Things about Frost Pllc

Things about Frost Pllc

Blog Article

A Biased View of Frost Pllc

Table of ContentsFrost Pllc - Truths4 Easy Facts About Frost Pllc ShownThe Best Guide To Frost PllcSome Ideas on Frost Pllc You Should KnowThe Of Frost Pllc

CPAs are among one of the most relied on professions, and forever reason. Not only do CPAs bring an unrivaled level of knowledge, experience and education and learning to the process of tax planning and handling your cash, they are particularly educated to be independent and objective in their job. A CPA will certainly help you safeguard your interests, listen to and address your problems and, similarly crucial, give you comfort.Working with a neighborhood CPA company can favorably influence your organization's economic health and wellness and success. A regional CPA company can aid minimize your company's tax worry while ensuring conformity with all suitable tax laws.

This growth reflects our dedication to making a positive influence in the lives of our clients. When you work with CMP, you come to be component of our household.

What Does Frost Pllc Mean?

Jenifer Ogzewalla I have actually worked with CMP for numerous years now, and I have actually actually appreciated their proficiency and performance. When auditing, they work around my schedule, and do all they can to preserve connection of employees on our audit.

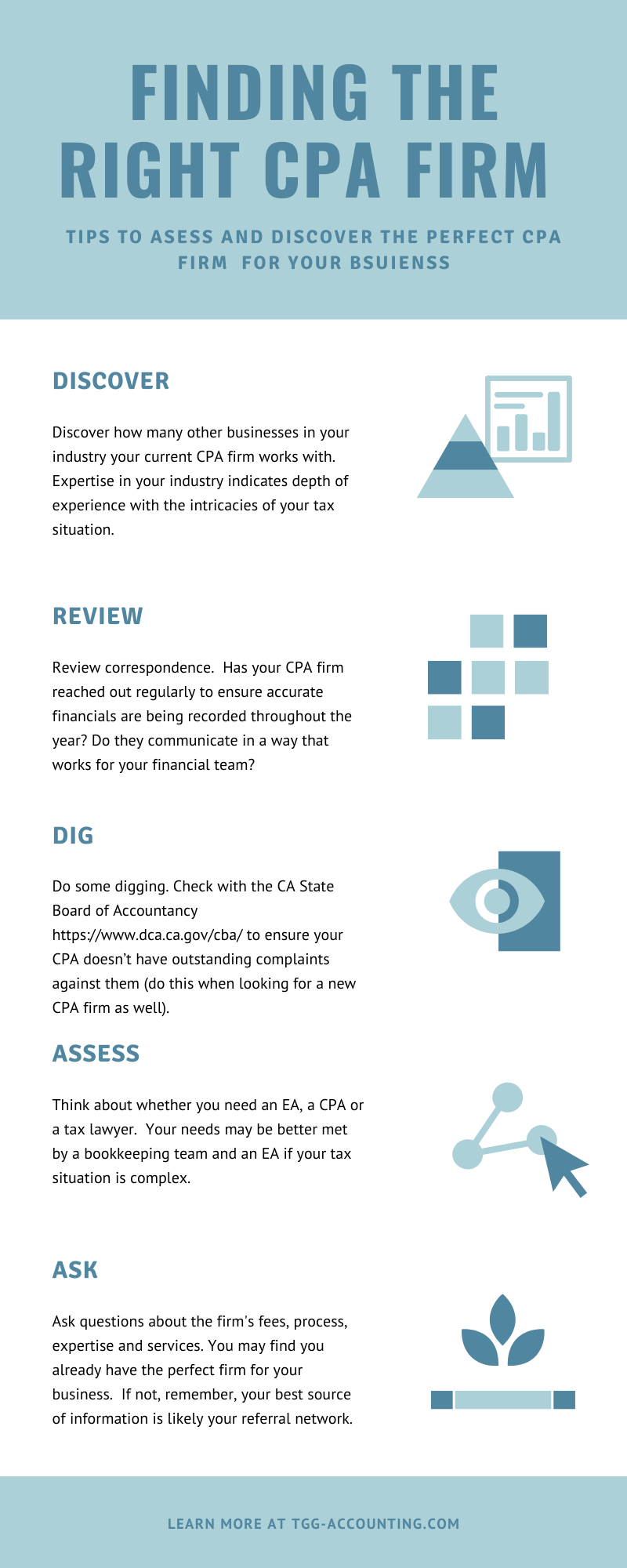

Here are some essential questions to assist your decision: Examine if the certified public accountant holds an active certificate. This guarantees that they have actually passed the required exams and meet high moral and specialist standards, and it reveals that they have the certifications to handle your economic issues properly. Validate if the CPA provides services that straighten with your organization needs.

Small companies have distinct monetary demands, and a CPA with appropriate experience can offer even more customized advice. Inquire about their experience in your market or with services of your size to guarantee they recognize your details obstacles. Understand how they bill for their services. Whether it's per hour, flat-rate, or project-based, recognizing this upfront will certainly avoid surprises and verify that their services fit within your spending plan.

Working with a local Certified public accountant firm is more than just contracting out monetary tasksit's a wise financial investment in your service's future. CPAs are certified, accounting experts. Certified public accountants may function for themselves or as component of a company, depending on the setup.

Indicators on Frost Pllc You Need To Know

Taking on this obligation can be a frustrating job, and doing something wrong can cost you both monetarily and reputationally (Frost PLLC). Full-service CPA companies are acquainted with declaring requirements to ensure your business follow government and state legislations, along with those of financial institutions, investors, and others. You may require to report additional earnings, which may need you to submit a tax return for the first time

group you can rely on. Call us for even more info about our services. Do you comprehend the audit cycle and the actions included in guaranteeing correct monetary oversight of your company's monetary health? What is your company 's legal structure? Sole proprietorships, C-corps, S companies and collaborations are exhausted in different ways. The more complex your revenue sources, places(interstate or global versus neighborhood )and industry, the more you'll need a CPA. Certified public accountants have a lot more education and learning and undergo a strenuous certification procedure, so they cost more than a tax obligation preparer or bookkeeper. On average, little services pay in between$1,000 and $1,500 to employ a CERTIFIED PUBLIC ACCOUNTANT. When margins are tight, this cost may beunreachable. The months before tax day, April 15, are the busiest season for Certified public accountants, adhered to by the months before the end of the year. You might need to wait to obtain your inquiries answered, and your tax return can take longer to finish. There is a limited variety of CPAs to go around, so you might have a difficult time locating one particularly if you have actually waited up until the last minute.

CPAs are the" huge guns "of the audit industry and usually don't take care of day-to-day accounting tasks. You can guarantee all your funds are current which you remain in excellent standing with the internal revenue service. Hiring an audit firm is an obvious choice for intricate services that can manage a certified tax obligation expert and a superb option for any type of little company that wishes to minimize the opportunities of being examined and offload the worry and headaches of tax obligation declaring. Open rowThe distinction in between a certified public accountant and an accounting professional is simply Bonuses a legal distinction - Frost PLLC. A certified public accountant is an accounting professional accredited in their state of procedure. Just a CPA can offer attestation services, function as a fiduciary to you and act as a tax attorney if you deal with an IRS audit. No matter your scenario, also the busiest accountants can eliminate the moment concern of filing your tax obligations yourself. Jennifer Dublino added to this write-up. Source interviews were conducted for a previous variation of this article. Audit firms might likewise employ Certified public accountants, however they have various other types of accounting professionals on team too. Often, these various other sorts of accounting professionals have specialties across locations where having a certified public accountant license isn't needed, such as monitoring audit, not-for-profit bookkeeping, expense accountancy, government accountancy, or audit. That doesn't make them less qualified, it just makes them differently qualified. For these stricter policies, CPAs have the legal authority to authorize audited economic declarations for the purposes of approaching capitalists and safeguarding funding. While audit companies are try this site not bound by these same policies, they should still follow GAAP(Normally Accepted Bookkeeping Principles )ideal techniques and display high

moral criteria. For this factor, cost-conscious tiny and mid-sized business will often utilize an audit services business to not just satisfy their bookkeeping and audit needs currently, however to scale with them as they grow. Don't let the regarded status of a business packed with Certified public accountants distract you. There is a misconception that a certified public accountant firm will do a better work due to the fact that they are legitimately permitted to

embark on more tasks than an accountancy business. And when this holds true, it doesn't make any sense to pay the premium that a CPA firm will certainly bill. Organizations can save on costs considerably while still having actually high-grade job done by making use of an accountancy solutions company rather. Therefore, utilizing an accounting solutions company is often a much better value than hiring a CPA

The 6-Second Trick For Frost Pllc

company to support your continuous economic administration initiatives. If you only require interim audit aid while you work with working with a full time accounting professional, we can assist with that as well! Our audit and finance employers can help you generate the appropriate prospect for an internal duty. Contact us to learn more today!. They can collaborate to ensure that all aspects of your financial plan are lined up and that your investments and tax approaches interact. This can lead to far better end results and more reliable use of your resources.: Functioning with a consolidated certified public accountant and financial adviser can save prices. By having both experts collaborating, you can avoid replication of solutions and potentially reduce your general costs.

CPAs likewise have know-how in creating and improving organizational plans and procedures and analysis of the practical requirements of staffing versions. A well-connected Certified public accountant can take advantage of their network to aid the company in numerous calculated and seeking advice from roles, effectively linking the organization to the ideal candidate to fulfill their requirements. Following time you're looking to load a board seat, consider reaching out to a CPA that can bring worth visit this site right here to your company in all the methods listed above.

Report this page